eCommerce opened doors for many other business models including models around financials. Fintechs and banks have emerged with different payment models and another one that has been gaining ground is the BNPL or the Buy Now, Pay Later.

BNPL allows consumers to buy any item without paying for it upfront rather than have the payment distributed in some instalments at a fixed payment schedule. Most BNPL providers do not charge any interest and even if they do it’s minimal.

The BNPL model has changed the online payment scenario and is transforming digital retail to a great extent. Easy payments and comfortable buying definitely enhances the overall consumer experience driving more sales.

Benefits:

- No processing charges and additional fees: Unlike traditional credit payment options, BNPL doesn’t ask for processing fees or any other hidden charges making it super easy and comfortable for customers to make purchases.

- Flexible repayments: It’s always convenient for customers when they don’t have to pay the entire amount at once and even more convenient when there are no-cost EMIs. BNPL offers customers a seamless purchase experience and unburdens them of the extra money they have to pay in the name of interest. Even though credit cards make it easy to buy expensive stuff but the interest on the payment is usually an uncomfortable experience for buyers. With BNPL, one can pay the amount in fixed and scheduled instalments.

- No documentation hassle: BNPL allows one to use the services without submitting documents and undergoing long processes rather it just requires a quick KYC. This makes it very accessible and comfortable.

- Higher conversion rates: The average cart abandonment rate for the year 2021 was found to be 69.82% concluding from 46 reports. Around 7% of the people left their carts abandoned due to unsuitable payment methods. BNPL now gives a chance to retailers to get this per cent converted.

- Customer experience: A seamless shopping experience keeps your customers coming back to you. From a fine website design to excellent pictures, from awesome products to satisfying prices, customers want a great experience. effortless checkouts with a variety of payment options add to the overall shopping experience for the customers. BNPL offers convenient payments by unburdening the shopper of paying the complete amount in one go.

Consumers are always looking for convenient ways to buy products and BNPL has proved to be their saviour. Consumers face many challenges while shopping for example everyone does have an aversion towards paying credit card interest but it proves to be the last resort if there are no other options. At times a consumer might not have a budget for something but wouldn’t want to miss the chance of buying it too, that becomes a real dilemma.

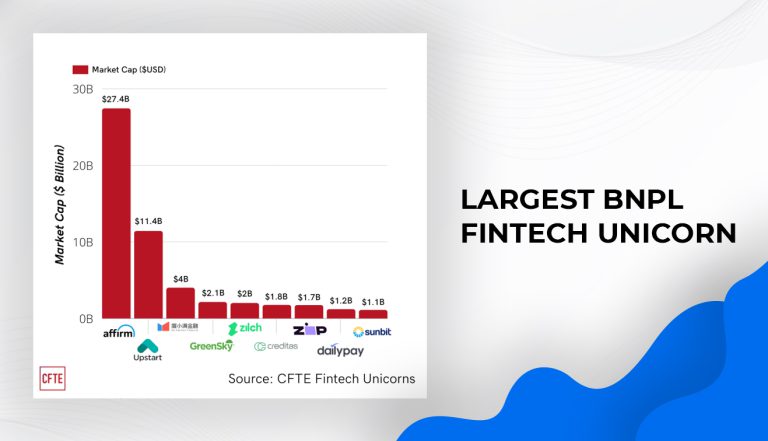

Top Companies in the BNPL market:

Among the leading BNPL providers, many Fintechs too have managed to set foot in the sector.

Below are the BNPL fintech giants by market capitalisation. Affirm has the biggest market share with a whopping $27.4 B, followed by Upstart, Du Xiaoman FinancialP, Green Sky, Ziltech, Creditas, Zip Co, Daily Pay, and Sunbit.

_ Why do you need one.png?h=250&fm=webp)

.png?h=250&fm=webp)

copy.png?h=250&fm=webp)

.jpg?h=250&fm=webp)

.jpg?h=250&fm=webp)

.png?h=250&fm=webp)

.png?h=250&fm=webp)

.jpg?h=250&fm=webp)

.jpg?h=250&fm=webp)

.png?h=250&fm=webp)

.png?h=250&fm=webp)

.png?h=250&fm=webp)

.png?h=250&fm=webp)

.png?h=250&fm=webp)

.png?h=250&fm=webp)

.png?h=250&fm=webp)

.png?h=250&fm=webp)

.png?h=250&fm=webp)

.png?h=250&fm=webp)

.png?h=250&fm=webp)

.png?h=250&fm=webp)